Hello Rocket Lab shareholders! Let's dive into the company’s latest earnings!

Rocket Lab has just wrapped up another record-breaking year:

Completed 16 successful Electron launches, setting a new annual record.

Secured over $450 million in contracts.

Became the first launch provider to execute two missions within 24 hours from different hemispheres.

Made significant progress on Neutron, successfully firing its first Archimedes engine.

Electron recently became the fastest commercial rocket to reach 50 launches, surpassing SpaceX’s Falcon 9 by a full year.

Looking ahead, Neutron remains on track for a 2025 debut, though the timeline has shifted slightly—from mid-year to the second half. Founder and CEO Sir Peter Beck told shareholders during the earnings call that this will give their teams a bit more time. If Neutron follows Electron, it will have gone from concept to launch in a little more than four years. That’s remarkably fast for the development of a new rocket.

Like many space stocks, RKLB 0.00%↑ surged throughout 2024, nearly multiplying its market cap by 10. The stock gained momentum through catalysts, including strong earnings and steady progress toward Neutron’s maiden launch in 2025. Last summer, the company released the first images and videos of Archimedes, the engine for Neutron, being tested in Mississippi. Since then, teams have been refining the engine through continuous testing, and their efforts paid off! They managed to reduce the engine’s mass by 200 kg. With a total of 10 engines on the rocket, this will likely save approximately four tons on the rocket, leading to potentially more payload capacity!

Following the U.S. elections on November 5, Rocket Lab’s stock tripled, as investors expected President Trump to make space a priority for his next term. The stock surged again the day following his inauguration on January 20, reaching a new all-time high of $33.34. However, with recent macroeconomic concerns, many small companies, including Rocket Lab have been impacted significantly. The day following Q4 earnings report, the stock briefly opened more than 50% lower than its all-time high from just a month ago. Surprisingly, it ended the day green.

After an incredible 700% surge in just 8 months, the recent dip raises questions. Was this decline a natural correction, or is the stock currently being driven by macroeconomic factors and market sentiment? Are investors concerned that the company may not launch Neutron this year as planned?

Let’s take a closer look at Rocket Lab’s Q4 2024 earnings!

Understanding Rocket Lab’s Business Model

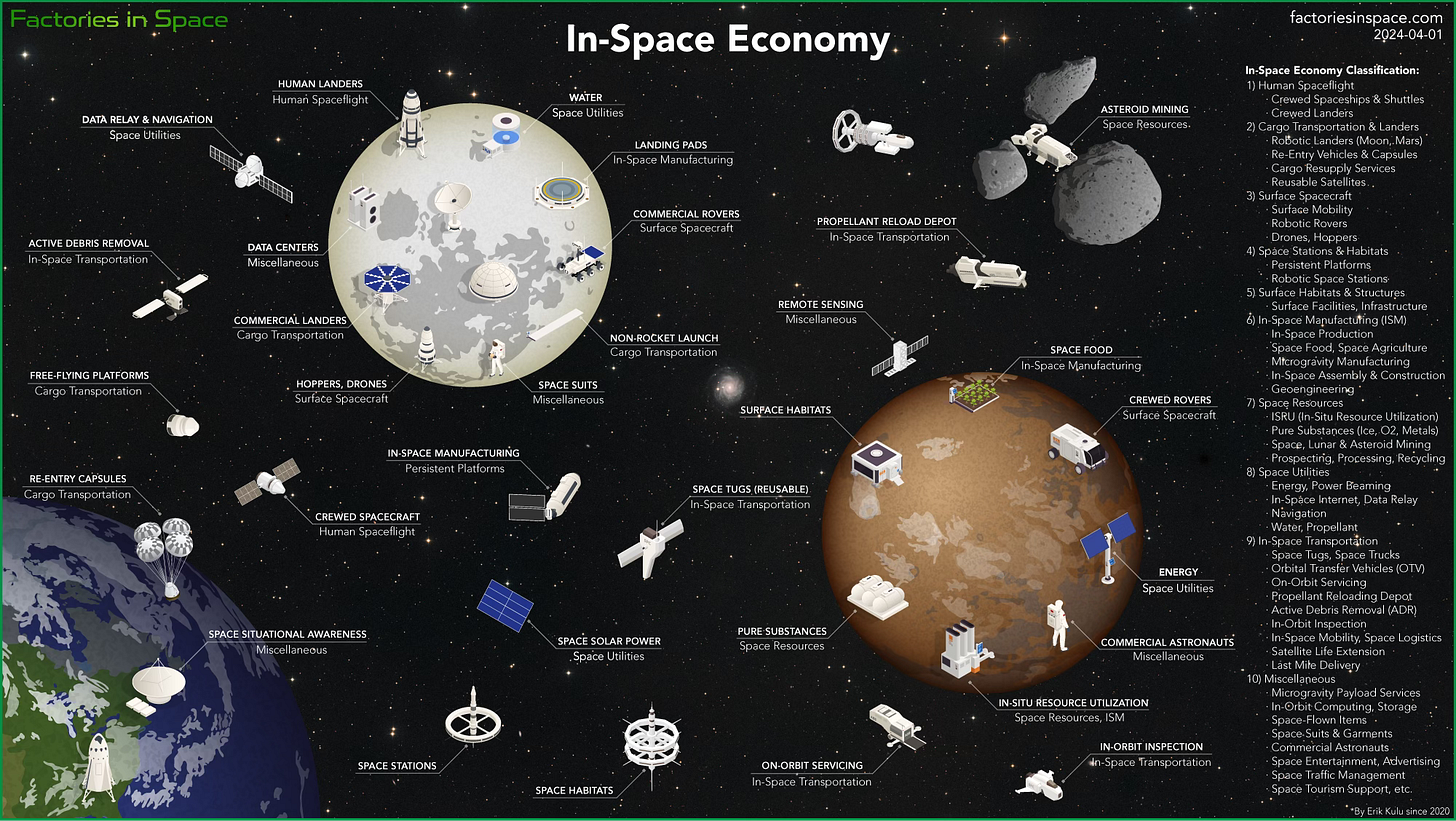

Before diving into Rocket Lab’s Q4 earnings, let’s first take a look at the key revenue segments that drive the space industry to better understand Rocket Lab’s business model.

Many space companies specialize in specific segments within the industry. For example, the publicly traded Japanese company AstroScale focuses on debris removal in low-Earth orbit (LEO), AstroForge is dedicated to asteroid mining, and Axiom Space specializes in commercial space stations. There are all types of companies across the space industry.

In recent years, many space companies have begun diversifying their business by offering end-to-end services across multiple segments. This strategy helps diversifying their revenue streams and maximize growth potential. Let’s not forget… space is hard.

“Space is hard” became a well-known saying within space companies and agencies, whenever rockets unexpectedly exploded or small mistakes led to catastrophic accidents, closing doors and opportunities.

The space industry is one of the toughest industries to succeed in. Even with the best engineers and a product that works perfectly on the ground after thorough testing, there’s no guarantee it will necessarily work as intended once launched (in the case of rockets) or function properly (in the case of spacecraft). A simple communication issue between a spacecraft and the ground can be enough to cause a mission failure. A propellant leak caused by a damaged seal from rocket vibration can be enough to trigger an explosion as well. There are thousands of ways a mission can fail.

This is why many space companies struggle.

Developing and testing space technology is incredibly expensive, and multiple unexpected failures can quickly lead to financial instabilities. When missions don’t go as planned, it not only costs a lot of money for the company, but it also ruins customer trust, making it harder to secure contracts.

The high costs, risks, and unpredictability are the main reasons so many space companies don’t survive. Just like investing, it’s wise not to put all your eggs in one basket, so it’s a great thing space companies look for diversifying their revenue.

Rocket Lab’s Business Model

From the beginning, Rocket Lab’s goal has been to become an end-to-end space company—designing, manufacturing, and testing components and spacecraft to launching and operating them with their own rockets and flight systems—all while meeting customer demand.

“We are not just a launch company, not just a spacecraft company, we are an end-to-end space company”

— Sir Peter Beck, Founder and CEO

The company’s Electron rocket is the second most frequently launched U.S. rocket. Its upcoming partially reusable rocket, Neutron, is designed to carry heavier payloads and launch megaconstellations. Through its space systems division, Rocket Lab has supported over 1,700 missions worldwide. The company develops spacecraft, components, and subsystems—including solar panels, reaction wheels, star trackers, and radios—as well as software, all to meet customer demand.

Headquartered in Long Beach, California, Rocket Lab operates facilities across North America and New Zealand. The company acquired Sinclair Interplanetary in April 2020, Advanced Solutions in October 2021, Planetary Systems Corp in November 2021, and SolAero Technologies Corp in January 2022.

Rocket Lab’s revenue is primarily divided into two segments:

Launch Services — Designing, manufacturing, and launching orbital rockets to deploy payloads to various Earth orbits and interplanetary destinations. As of December 31, 2024, they have launched and deployed over 200 spacecraft for government customers, including the U.S. Department of Defense, NASA, and other U.S. government agencies, as well as major domestic and international commercial and government operators. In total, their launch services have been used by over 20 organizations.

Space Systems — Designing and manufacturing spacecraft components and flight software. As of December 31, 2024, they have flight hardware and spacecraft that have flown on over 1,800 missions.

Neutron Updates

Maiden flight pushed to second half of 2025

Rocket Lab reaffirmed that Neutron's first launch is still planned for 2025 but has been pushed from mid-year to the second half, to allow their teams to have a little bit more time to complete testing, engineering, qualification, manufacturing, and infrastructure milestones. In its 10-K filing, the company also acknowledged the uncertainty in developing a new launch vehicle, which could cause further delays.

“We’re giving ourselves a little bit more time to get it to the pad and get the launch. But I mean, we’re talking months here. It’s not very material.”

— Sir Peter Beck, Founder and CEO

Rocket Lab’s latest 10-K filing highlights the challenges of developing and launching the Neutron rocket. While they have made significant progress in 2024 in building Neutron’s structure, testing its engine, and starting production, the company acknowledges that developing a new rocket “is inherently time-consuming and involves numerous risks throughout the engineering and manufacturing development cycle, any of which could create delays in reaching the initial launch and future launches of the completed vehicle.” Even if Rocket Lab meets its goal for Neutron’s first launch, the company acknowledges making enough rockets while keeping quality high will be another challenge. Any delays in development or production could affect customer trust, revenue, and the overall business performance.

Neutron’s launch infrastructure

Located at the Mid-Atlantic Regional Spaceport within the NASA Wallops Flight Facility on Wallops Island, Virginia, Launch Complex 3 (or LC-3) will support launches of Neutron. Over the last quarter, Rocket Lab has made significant progress on Neutron’s launch infrastructure, with the installation of the upper deck segment and the water deluge system completed.

Archimedes

Qualification of the Archimedes engine is ongoing ahead of Neutron’s first launch, with testing intensifying at Rocket Lab’s Mississippi facility. On August 8, the company announced the first successful hot fire test of the engine.

On January 30, the company announced that minor tweaks and iterations have led to a mass reduction of over 200 kg per engine.

Fun fact from the 10-K filing, Rocket Lab’s leased rocket engine testing complex at the Stennis Space Center is set to expire on October 22, 2032, but the company has the option to renew it for an additional ten years.

Introducing: Return On Investment

In their Q4 earnings’ presentation, Rocket Lab has introduced a landing platform, named Return On Investment, to support landing of the Neutron’s first stage. Like SpaceX’s Falcon 9 and Blue Origin’s New Glenn, the platform will be a repurposed barge, customized to support sea landings.

Modifications will include autonomous ground support equipment to capture and secure Neutron after landing, blast shielding to protect onboard systems, and station-keeping thrusters for precise positioning. Rocket Lab has already acquired the barge, and construction will take place throughout 2025, with plans to have it operational in 2026.

This also confirms that Neutron’s first stage will not attempt a landing on its maiden flight. Sir Peter Beck also mentioned that it will instead perform a “soft splashdown” in the ocean.

Rocket Lab Revenue Jumps 78.3% Year-Over-Year

Revenue and gross margins

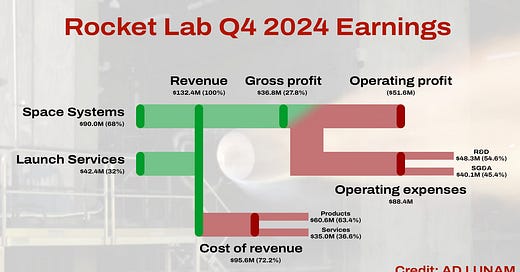

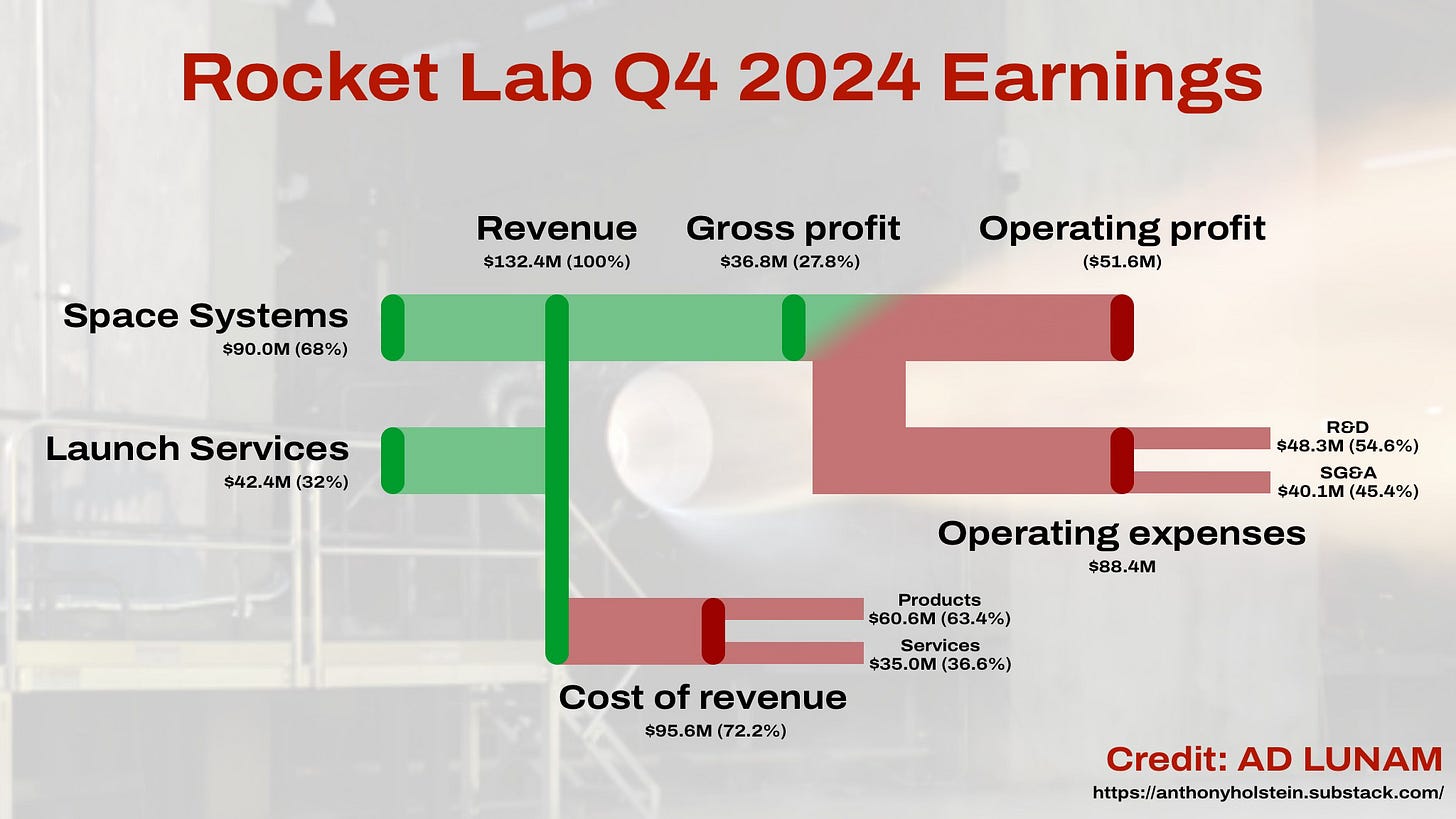

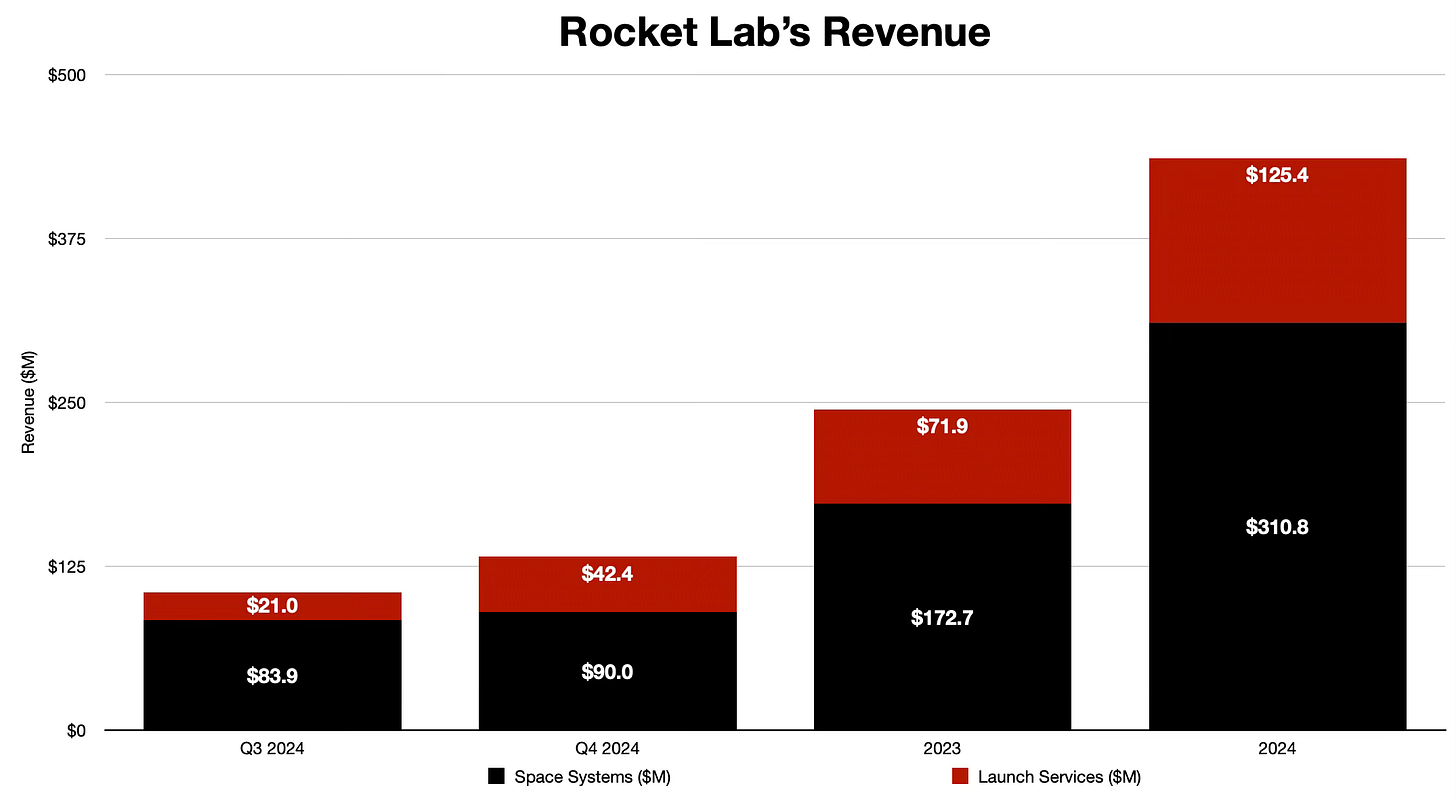

Rocket Lab’s Q4 2024 earnings showed strong growth, driven by more launches and expansion in its space systems business. The company reported $132.4 million in revenue, beating the $130.6 million estimate, which is a 26.3% increase from last quarter, a 78.3% jump year-over-year and a 121% jump Q4 year-over-year. This growth came from an increase in launches, rising from 3 to 5 in Q4 and from 10 to 16 for the full year, as well as higher revenue from satellite manufacturing contracts with MDA and SDA. Since going public in 2021, Rocket Lab’s revenue has grown by 381.8%.

In 2024, Rocket Lab significantly increased their launch cadence, which helped improve their gross margins as well. Overall, their non-GAAP gross margin increased to 34.0% in Q4 compared to 31.3% the previous quarter. Per the 10-K filing, the end-to-end company believes continued reduction in costs and an increase in production volumes will enable the cost of launch vehicles to decline and improve their gross margins.

According to same 10-K filing, Rocket Lab built 12 Electron launch vehicles in 2022, 11 in 2023, and 14 in 2024. The company notes that growth rates in launches and total launch service revenue are not perfectly correlated. This is because total revenue is influenced by various factors, such as the revenue per launch, which can vary due to unique orbit and insertion requirements, payload handling needs, launch location, mission time sensitivity, and other variables.

Keep reading with a 7-day free trial

Subscribe to AD LUNAM to keep reading this post and get 7 days of free access to the full post archives.